Make money from your unused cash

- Open your account in minutes

- No need for a reference account

- Full liquidity at all times, no lock in of funds

*Minimum deposit €1.000. 4% on up to €100.000 in deposits, then 1.5% on the remaining balance. This is a variable percentage that may change on an ongoing basis based on market conditions.

The Pile Treasury Account is like an overnight account designed for startups. It pays for itself and extends your runway.

If you deposit € into your Pile account, you’ll earn an extra €6.250 this year.

The Pile Treasury Account

The Pile Treasury Account is designed for startups and SMEs, providing easy-to-use treasury tools to extend your runway, simplify liquidity management, and make better financial decisions.

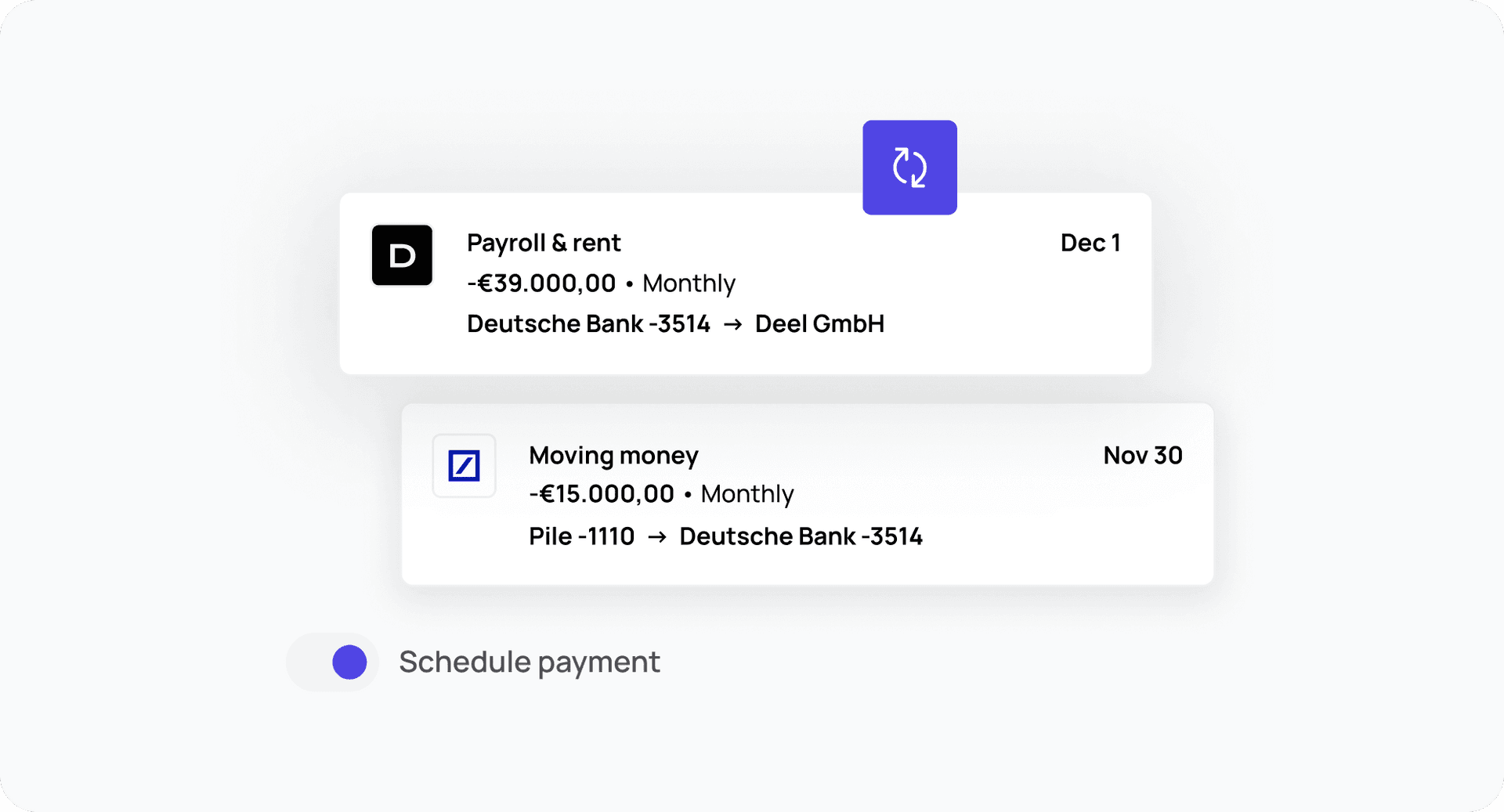

Ensure liquidity

No lock in periods — you always have access to the funds on your Pile account. Easily set up scheduled payments to your other accounts to ensure liquidity wherever you need it.

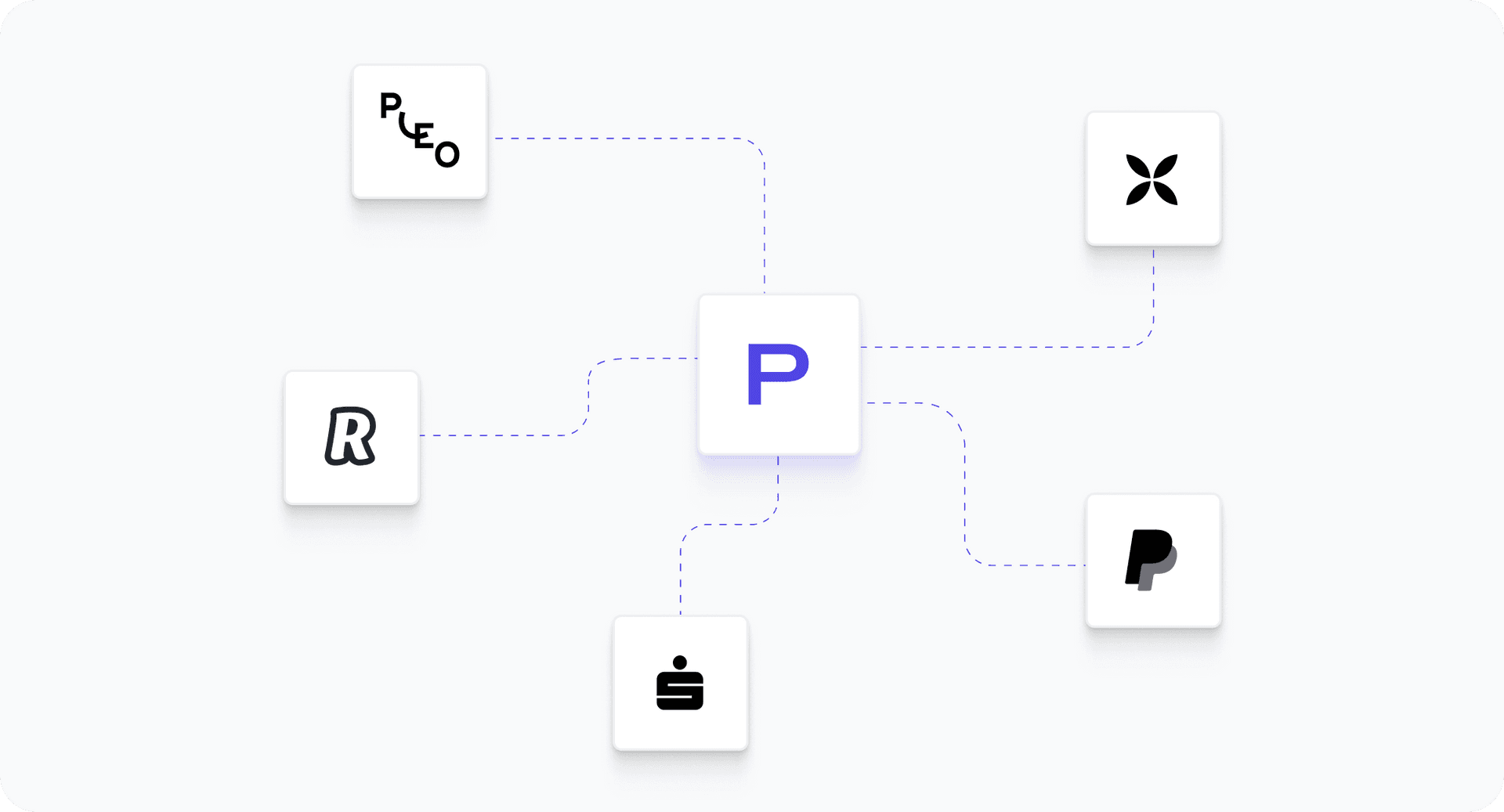

Connect your finance stack

Centralise your financial tools in one platform with the Pile Treasury Account. Connect bank accounts, wallets, and expense management tools effortlessly, all accessible with a single login.

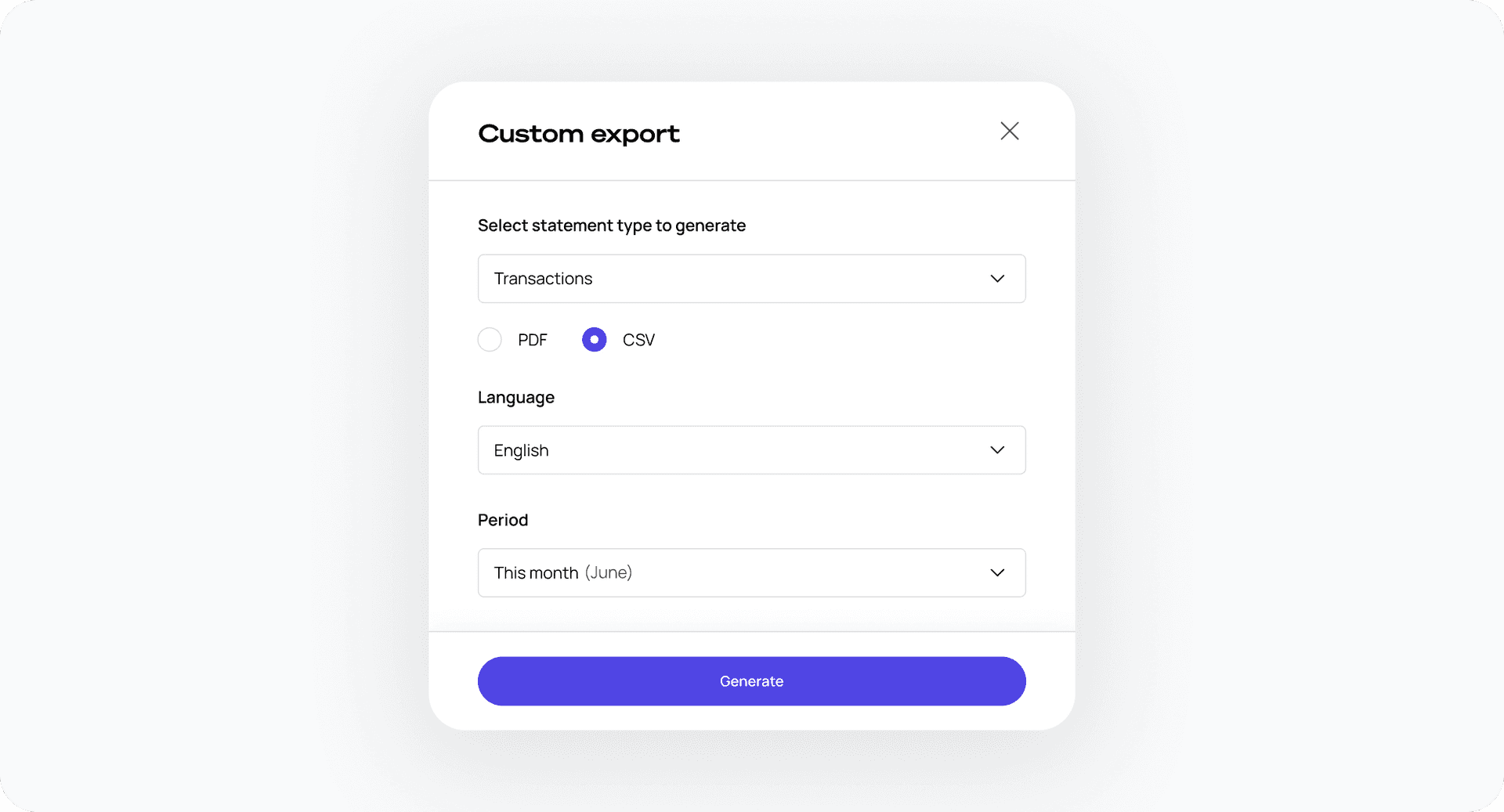

Make cash reporting easy

Eliminate tedious data tasks with quick, comprehensive transaction exports from all your connected banking partners in just a few clicks.

Matteo Benedetti

CEO and Co-founder

Debtist

Get started in under 10 minutes

Open your Pile treasury account and connect your existing setup

1. Fill out our online questionnaire

Just the basics about you and your company!

5 minutes

2. Verify your identity. No phone call needed.

We have a super simple verification process you can complete in just a few taps.

2 minutes

3. Transfer your idle cash

Once your documents are verified, you can easily move your idle cash to your Pile treasury account to automatically start earning.

1 minute

4. Grow your capital

Your earnings will be calculated on a daily basis and paid out quarterly. Your capital is always accessible whenever you need it.

Tools for easy treasury management

Free transfers in Europe

Easy to set up SEPA and instant payments anywhere, without any costs.

Intelligent payment automation

Set up automated transfers based on balances or dates across your accounts

4%* p.a. earnings

Earn up to 4%* p.a. on every euro in your Pile Treasury Account

Advanced transaction search

Find any transaction on any account. You can search for creditors, references, dates, amounts, and much more.

Easy reporting

Export detailed transaction data across all your accounts. No need for multiple log ins or tedious manual data gathering.

Multi-entity accounts

Open multiple Pile treasury accounts for all your businesses and manage them with a single login

*Minimum deposit €1.000. 4% on up to €100.000 in deposits, then 1.5% on the remaining balance. This is a variable percentage that may change on an ongoing basis based on market conditions.

Your money in safe hands

Thanks to our network of selected and regulated banking partners, you get the safety of a traditional bank with the interface of a modern technology company.

European Deposit Insurance Scheme (EDIS)

Backed by EDIS, your deposits are safeguarded up to €100,000, ensuring peace of mind and financial security in accordance with EU regulations.

PSD2 compliant

Adhering to the stringent PSD2 regulatory standards, we champion transparency and robust security measures to protect your financial data.

2-factor authentication

Your transactions are secured with two-factor authentication (2FA), adding an extra layer of defense against unauthorized access.

Fund safety

Your funds remain secure, even in the unlikely event of Pile's insolvency. Partnered with licensed and regulated institutions, we prioritize the complete safety of your funds.

FAQ's

What is Pile?

Pile is a treasury service app for high-growth startups from seed to Series C, as well as business angels and venture capitalists. Pile includes a bank account and access to various product features such as fixed deposits and overnight money, and allows you to set up your entire banking setup across multiple banks and view everything in a single dashboard overview. Pile helps you grow, manage and keep your capital safe.

Why should I use Pile?

If you're a high-growth startup or work with venture capital in general, you're probably looking for a place to keep your capital safe but also effective. Pile helps you do that.It's the central place where the European startup scene keeps their money - with pooled views across multiple bank accounts and access to a range of financial instruments from fixed deposits to overnight money.Whether you are just starting to build a good bank portfolio or already have two to three accounts spread across Europe, Pile is the best option to keep everything in view and therefore under control.

How much does Pile cost?

Pile's services are available from a basic fee of €19 per month, which covers both the cost of the bank account, connecting external bank accounts and access to financial products such as fixed deposits or overnight money. For further features, such as automated payments, different price plans are available depending on the size of your business and the number of bank accounts you want to integrate, as well as the amount of capital deposited.

Is Pile a bank?

Pile itself is not a bank, but a technical service provider that does not offer regulated financial services. All regulated financial services are operated by our banking partner, Swan, who are a registered e-money institution and a EBA-STEP2 BNP Paribas SEPA Indirect Participant, thereby under the supervision of the European Banking Association, BaFin in Germany and ACPR in France.

What are the requirements to open a Pile account?

To open an account with Pile, your business must be based in Europe and registered with the local tax authority. We welcome businesses of all stages of development and sizes.

How long does it take to open a Pile account?

Registration takes about 10 minutes. The account approval process depends on the partner bank's Know-Your-Business (KYB) and Know-Your-Customer (KYC) processes, which usually just takes a couple of hours, depending on the complexity of your business structure.

How are my deposits protected?

All Pile partner banks belong to the European Deposit Guarantee Scheme, which means that in the event of a bank insolvency, deposits up to €100,000 are protected and will be returned in full within seven working days. At the same time, Pile makes sure to work with the best and most secure banks, to provide a hassle free financial service.

Ferdinand Dabitz

CEO and Co-founder

Ivy